Summary

Summary

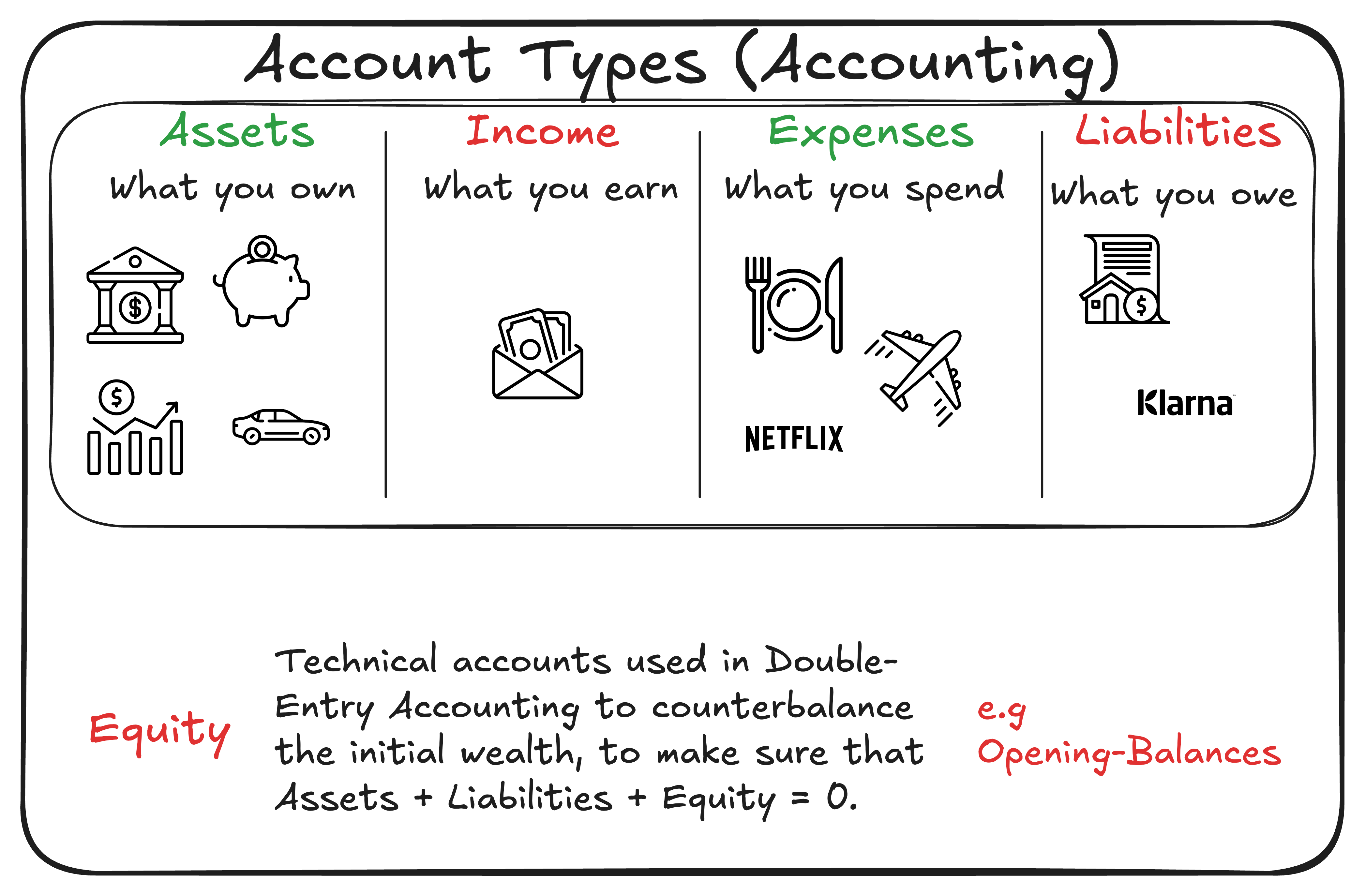

There are 4 main Account types + a technical one:

- Assets: something you own. It can be Bank Accounts, Cash, Stocks, but also tangible properties, e.g. cars, houses, collectibles.

- Income: Something you earn. It can be Salary, Gift, Dividends, etc.

- Expenses: Something you spend. It can be Groceries, Travel, Subscriptions, Books, etc.

- Liability: Something you owe: It can be from car mortgage, Buy now Pay Later, taxes, etc.

- Equity: In the Beancount context it is used at the beginning to track the initial wealth, before you started tracking your finances. At the beginning (before tracking any spending/earning) you should have . Equity accounts are only used at the beginning, when moving the initial funds to their Assets/Liabilities.

Each Account has a Balance, which is updated with transactions between Accounts. e.g. Account A having balance 10€ performs a 5€ transaction to Account B having balance 20€. The updated balances for A and B will be 5€ and 25€.

Assets and Expenses have positive balances, whereas Income and Liability have negative balances.

Assets and Liability are useful to track the net worth in a specific point in time (your net worth can be , whereas Income and Expenses are helpful to analyze the spendings and earnings over a time window (e.g. in the past 6 months).

An Example

An example might clarify the differences between the account types and the relationships between them.

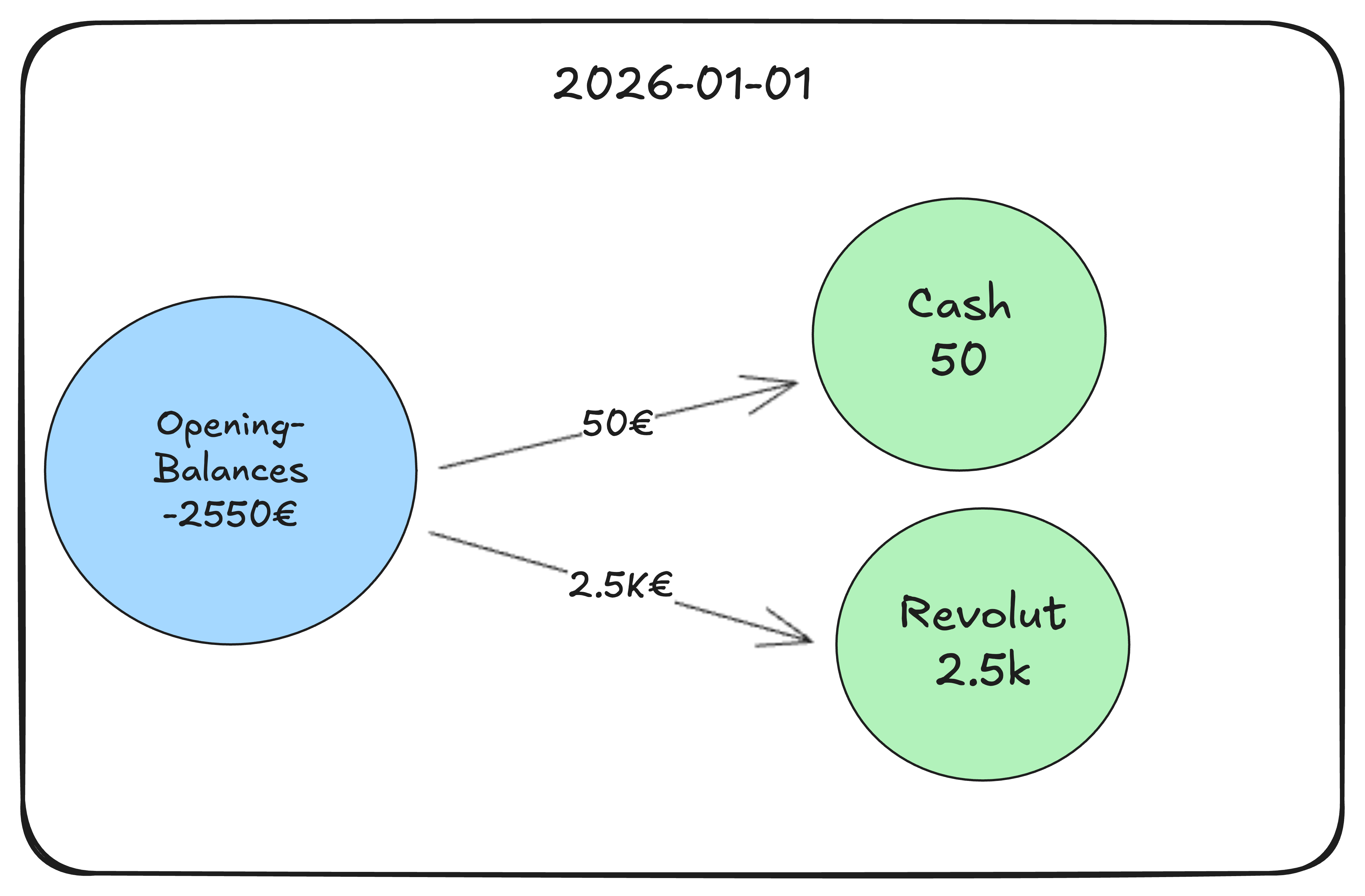

We want to track our finances starting on 2026-01-01. Our initial wealth is 2.5k € from a Revolut Account and 50€ cash. In order to inject the initial wealth to Revolut and Cash accounts, we need to create 2 transactions from the Opening-Balances’ equity account to the Revolut and Cash accounts.

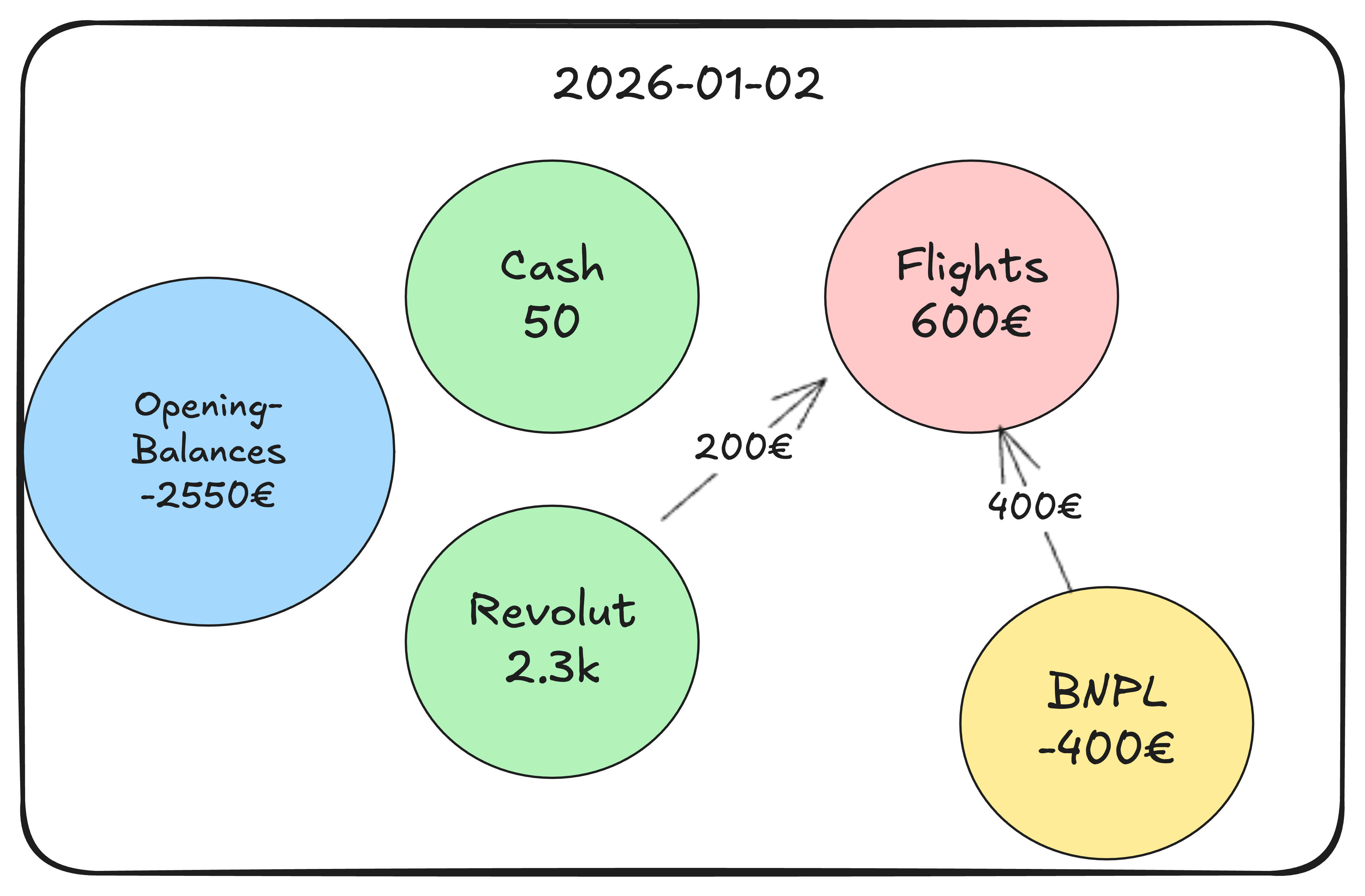

On 2026-01-02, we paid 600€ for our flight to Albuquerque. We start by creating a Flights Expenses Account. In order to make things a bit more complex, let’s suppose we use a Buy now Pay Later (BNPL) and decide to pay in 3 equal installments (200€ each). In this case we should also create a BNPL Account under Liabilities. And on 2026-01-02, we would have two different transfers:

- From Revolut to Flights: 200€

- From BNPL to Flights: 400€

This is because the flight is paid for by two parties: €200 with our own money, and the remaining €400 is borrowed from the BNPL company.

This is because the flight is paid for by two parties: €200 with our own money, and the remaining €400 is borrowed from the BNPL company.

When the next month we have to pay for the second installment, we will create a transaction from Revolut to BNPL accounts (Flights Account is not involved anymore, because we already have assigned 600€ on the date when we bought the ticket, 2026-01-02).

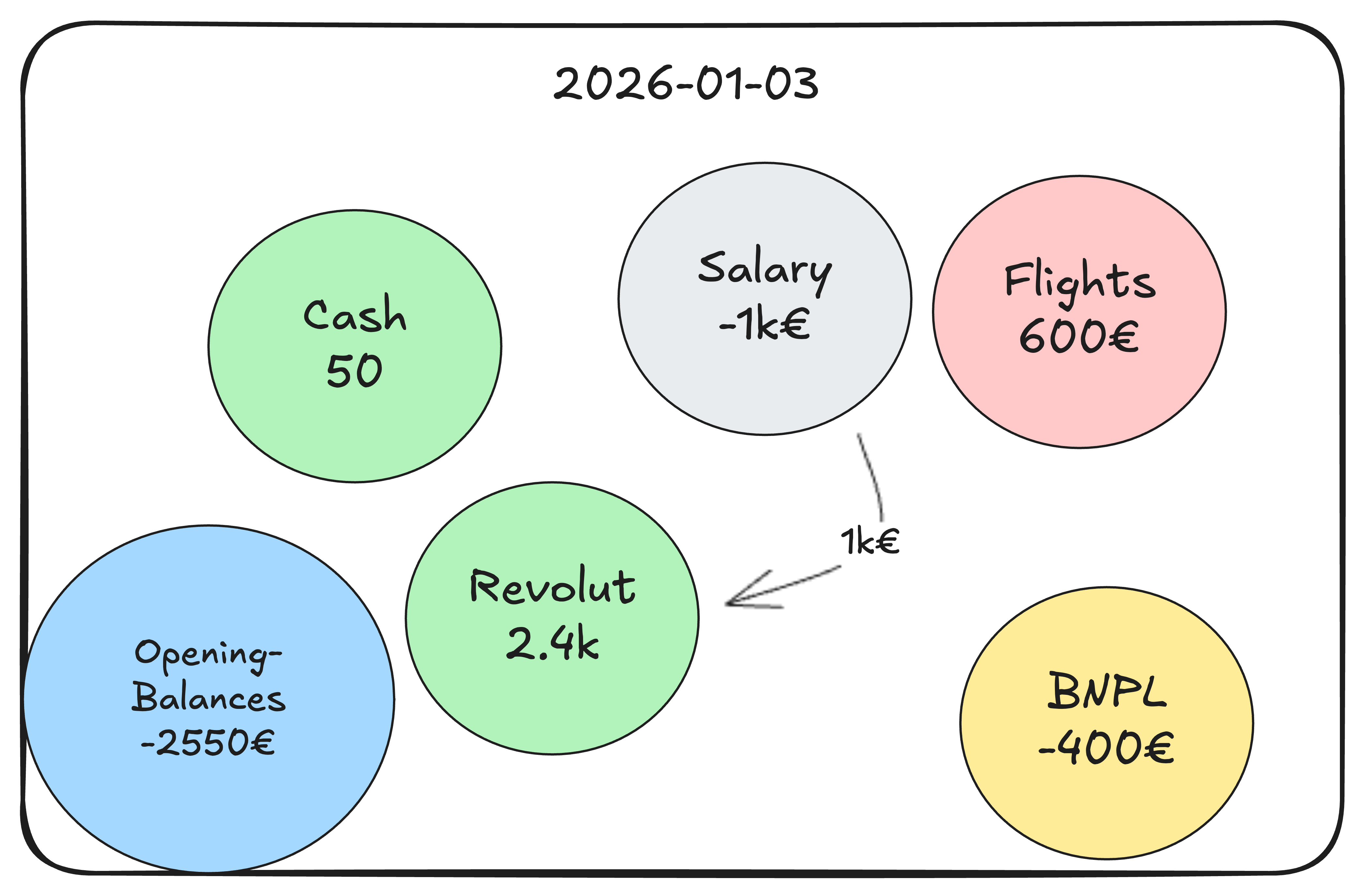

On 2026-01-03, we finally get our salary. From Salary Account we move 1k€ to Revolut Account.

We can then infer some data:

- Net Worth as of 2025-06-03: it is given by Assets + Liability: 50€ + 2.4k€ + (- 400€) = 2850€

- Total Expenses in Jan-2026: By Analyzing the entries associated with Expenses Accounts and recorded in January (Flights only), we can get the total amount: 600€

- Total Income in Jan-2026: by summing up all the entries associated with Income Accounts and recorded in January (Salary only), we can get the total amount: 1k€

Short Note

I agree that many definitions are missing (what is Double-Entry account, what are an Account and a transaction?) I will probably cover these principles in new Flashcards.

Credits and References

- The double-entry Counting Method, Beancount documentation

Licenses and Attributions

- Airplane, Bank, Netflix, Piggy bank, Restaurant, Car, Klarna icons made by Freepik from flaticon.com

- Mortgage icon made by iconixar from flaticon.com

- Salary icon made by nawicon from flaticon.com from flaticon.com

- Stock market icon made by talha-dogarfrom flaticon.com